Offences Fines and Penalties. Hak Cipta Terpelihara 2022 Lembaga Hasil Dalam Negeri Malaysia.

How To File For Income Tax Online Auto Calculate For You

Overpaid Taxes Can Be Refunded In The Form Of A Tax Return.

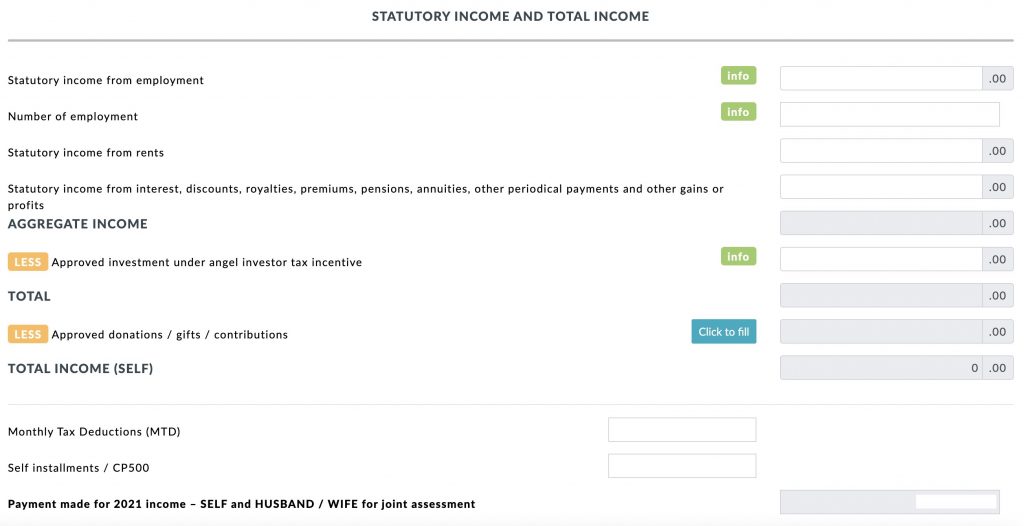

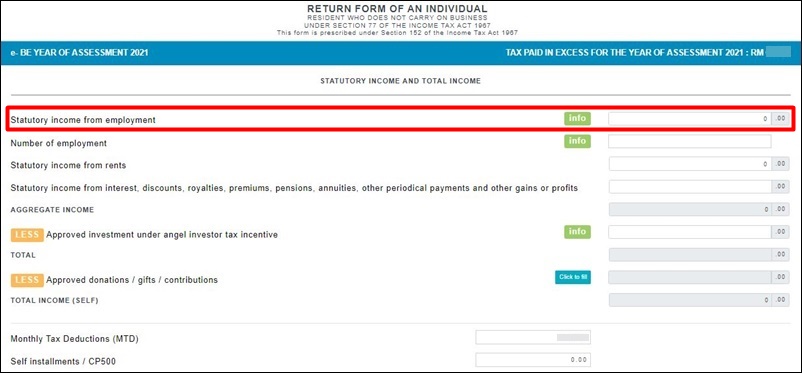

. Business Employment and Other Income. The TP1 is an income tax form that is given to the employer by the employee to ensure that the MTD monthly tax deductions have taken into account the necessary rebates and deductions. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

When should we submit our tax form if we choose for joint assessment or separate assessment. Receiving tax exempt dividends. LEMBAGA HASIL DALAM NEGERI MALAYSIA RETURN FORM OF AN INDIVIDUAL RESIDENT WHO DOES NOT CARRIES ON BUSINESS UNDER SECTION 77 OF THE INCOME TAX ACT 1967 This form is prescribed under section 152 of the Income Tax Act 1967 2021 YEAR OF ASSESSMENT BE Form 1 CP4B Pin.

Determination Of Chargeable Gain Allowable Loss. If applicable use ITNS 280 ITNS 281 ITNS 282 ITNS 283 ITNS 284 or Form 26 QB demand payment only for TDS Tax Deducted at Source on property sales. Lembaga Hasil Dalam Negeri Malaysia Bahagian Pengurusan Rekod Maklumat Percukaian Jabatan Operasi Cukai Karung Berkunci 00222 43650 Bandar Baru Bangi Selangor Malaysia.

HK-7 Not Applicable to Form BE Not Enclosed - HK-8 Income from Countries which have Avoidance of Double Taxation 30 Agreement with Malaysia and Claim for Section 132 Tax Relief HK-9 Income from Countries Without Avoidance of Double Taxation 30 Agreement with Malaysia and Claim for Section 133 Tax Relief. Income Tax electronic payment is convenient easy and secure. Criteria on Incomplete ITRF.

Tax Offences And Penalties In Malaysia. Separate assessment - Due date for submission of Form BE is 30th April. IRBM Public Key.

Income Tax Return Form ITRF Every individual in Malaysia including resident or non-resident who is liable to tax is required to declare his income to Inland Revenue Board of Malaysia IRBM or Lembaga Hasil Dalam Negeri Malaysia LDHN. The rate of deduction and rebates depends on the approval of the. On the other way round according to the Income Tax Act 1967 only income derived from Malaysia is subject to.

Click on e-Filing PIN Number Application on the left and then click on Form CP55D. Income Tax Act 1967 International Affairs. This form can be downloaded and submitted to.

As a non-resident youre are also not eligible for any tax deductions. Guide To Using LHDN e-Filing To File Your Income Tax. Enter all the mandatory.

How Does Monthly Tax Deduction Work In Malaysia. Click on Permohonan or Application depending on your chosen language. Change In Accounting Period.

2 Failure to furnish a return on or before the due date for submission. Go back to the previous page and click on Next. Schedule On Submission Of Return Forms RF Contoh Format Baucar Dividen.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021. Amending the Income Tax Return Form. Real Property Gains Tax RPGT Rates.

Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the same no matter the amount of income. The deadline for filing your income tax returns form in Malaysia varies according to what type of form you are filing. The rebates and deductions are for book purchases insurance medical expenses and others.

Within 7 months from the close of the accounting period. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2020 for manual filing and 15 May 2020 via e-Filing. IRBM Stamp Duty Counter Operating Hours.

A 3442010 For Approved Knowledge Workers. The CP38 notification is issued to the employer as supplementary instructions to clear the balance of tax liability of employees over and above the Monthly Tax Deductions MTD 30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income. How To Pay Your Income Tax In Malaysia.

For the BE form resident individuals who do not carry on business the deadline falls on either 30 April 2022 manual filing or 15 May 2022 e-Filing. Tax Offences And Penalties In Malaysia. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any.

Basis Period for Company. Furthermore youll want to ensure that you file the form online. Dialog Minutes For Operational.

If taxable you are required to fill in M Form. Remittance Slip for Payment of Increase In Tax - Subsection 107A2 of the Income Tax Act 1967 Form CP1471 Pin 42014 This form can be downloaded and submitted to Lembaga Hasil Dalam Negeri Malaysia. The TP1 form is an income tax form that is given to an employer by an employee to make sure that all necessary rebates and deductions have been accounted for in the MTD monthly tax deductions.

Disposal Date And Acquisition Date. Return Form RF Filing Programme. How To File Your Taxes Manually In Malaysia.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Meanwhile for the B form resident. With Malaysia Government Subsidy you can have a certified highly accurate and trustworthy SQL Payroll Software at 50 of the original price now.

Introduction And Basis Of Taxation. Postcode Town State NG ITEMS TA Form IMPORTANT REMINDER 1 Due date to furnish this form and pay the balance of tax payable. Joint assessment Due date for submission both Form BE and B is 30th June.

Return Form RF Filing Programme For The Year 2021. Taxpayer is responsible to submit Income Tax Return Form ITRF and make income tax payment yearly prior. IRBM Revenue Service Centre Operating Hours.

MyTax - Gerbang Informasi Percukaian. How To Pay Your Income Tax In Malaysia. - Penalty under subsection 1123 of the Income.

Disposal Price And Acquisition Price. After logging in youll find various tax forms for individuals from different sectors. As a business in Malaysia youll want to avoid a fine of RM 200 RM 20000 andor a maximum of 6-month imprisonment term under the Income Tax Act Section 1201b.

MT 2021 Explanatory Notes. Choose your tax form. Self-employed individuals or employers will fill up Borang e-B.

Download a copy of the form and fill in your details. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. Usually employed individuals will fill up Borang e-BE.

Article on Advantages of Income Tax E Payment and Process for Income Tax Online Payment. I receive employment income Form BE and my wife has business income Form B. Guide To Using LHDN e-Filing To File Your Income Tax.

How To File Your Taxes If You Changed Or Lost Your Job Last Year

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

7 Tips To File Malaysian Income Tax For Beginners

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

7 Tips To File Malaysian Income Tax For Beginners

Niyet Etmek Yeterlik Ideal Garaj Tahmin Turist Tax Calculator Malaysia 2020 Upatreearts Org

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

The Complete Income Tax Guide 2022

Malaysia Personal Income Tax Guide 2022 Ya 2021

How To Step By Step Income Tax E Filing Guide Imoney

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

How To Step By Step Income Tax E Filing Guide Imoney

How To Step By Step Income Tax E Filing Guide Imoney

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Business Income Tax Malaysia Deadlines For 2021

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

How To File Your Taxes If You Changed Or Lost Your Job Last Year